Derniers Ajouts

Eric (2024)

HD

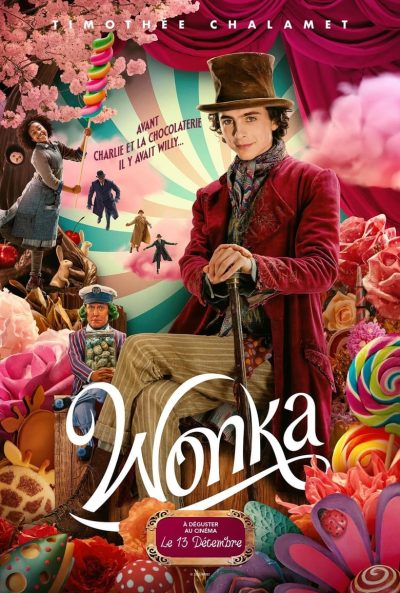

Wonka (2023)

HD

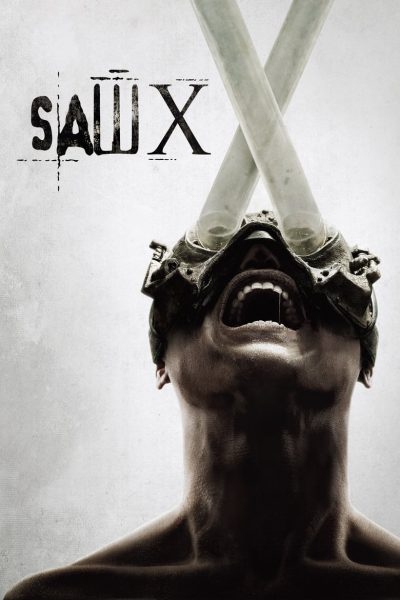

Saw X (2023)

HD

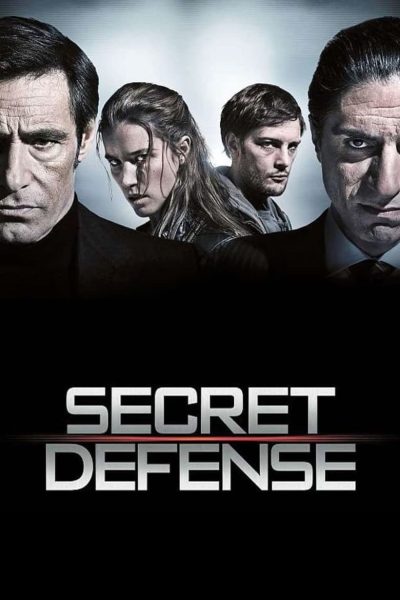

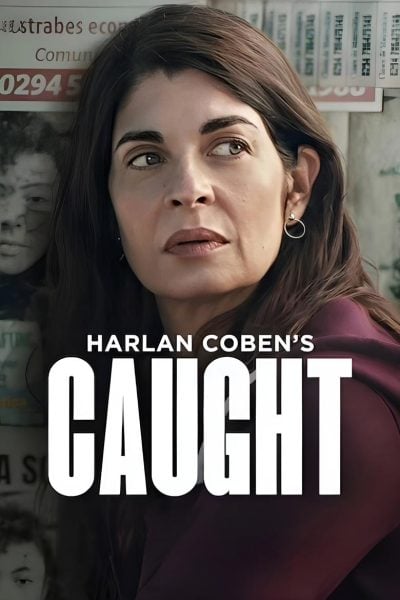

Secret Défense (2008)

Film·FR·10/12/2008·Thriller·1h 40min

Dans l'ombre des institutions gouvernementales françaises, se trame une histoire explosive : celle de Nathalie, analyste de renom au sein des services secrets français. Elle jongle avec les secrets les plus obscurs de l'État, tout en essayant de garder sa vie personnelle sous contrôle.

Son quotidien est bouleversé lorsque son mari, ingénieur en informatique, disparaît mystérieusement. Déterminée à le retrouver, Nathalie plonge dans un monde d'espionnage et de manipulations où elle devra faire face à ses propres démons.

Aidée par un collègue aussi séduisant que charismatique, Nathalie se lance dans une course contre la montre pour dénouer les fils de cette sombre affaire. Entre traîtrises, complots et rebondissements inattendus, elle devra jongler entre sa loyauté envers son pays et son désir de vérité.

Mais plus elle s'enfonce dans les méandres de cette intrigue, plus le danger se rapproche d'elle. Entre identités secrètes et alliances fragiles, Nathalie devra faire preuve de courage et d'ingéniosité pour démêler le vrai du faux.

Entre scènes d'action palpitantes et dialogues ciselés, "Secret Défense" est un thriller haletant qui vous tiendra en haleine jusqu'à la dernière minute. Entre révélations fracassantes et retournements de situation inattendus, le film vous plonge dans un univers où la vérité est le bien le plus précieux.

Préparez-vous à être embarqué dans une aventure aussi captivante que imprévisible, où les frontières entre amitié et trahison, loyauté et mensonge, se brouillent à chaque instant. Nathalie devra apprendre à se méfier de tout le monde, même de ceux en qui elle croyait le plus.

Entre humour et tension, "Secret Défense" vous emmène dans un voyage au cœur des coulisses de la sécurité nationale, où les enjeux sont aussi élevés que les risques. Préparez-vous à être surpris, ému et captivé par ce thriller riche en rebondissements et en suspense.

Dans un monde où les secrets sont le nerf de la guerre, une jeune analyste du renseignement se retrouve plongée dans un jeu dangereux de mystère et de trahison. Camille, brillante et ambitieuse, ne recule devant rien pour percer les mystères qui entourent la mort suspecte de son père, agent secret de renom. Alors qu'elle remonte le fil de ses investigations, elle se retrouve rapidement au coeur d'un complot international, où les alliances se font et se défont au gré des intérêts politiques et financiers.

Sa quête de vérité la mène sur les traces d'un réseau clandestin prêt à tout pour protéger ses intérêts, même au prix du sacrifice de vies innocentes. Entre manipulations et faux-semblants, Camille devra apprendre à naviguer dans les eaux troubles du monde de l'espionnage, où la confiance est un luxe rare et la paranoïa une seconde nature. Aidée d'un agent secret aux méthodes expéditives et d'un hacker génial mais instable, elle devra user de sa perspicacité et de son audace pour démêler le vrai du faux et déjouer les pièges tendus par ses ennemis invisibles.

Au fil de son enquête, Camille découvrira que la véritable menace ne réside pas seulement dans les ennemis étrangers, mais bien au sein même des services de renseignement qu'elle croyait pouvoir contrôler. Entre traîtres et alliés inattendus, elle devra jongler avec les mensonges et les manipulations pour sauver sa peau et préserver les secrets qui pourraient changer la face du monde. Mais dans ce jeu de dupes où chacun cache ses cartes, Camille devra faire preuve de courage et de détermination pour ne pas se laisser submerger par les forces obscures qui cherchent à l'anéantir.

Secret Défense est un thriller haletant qui plonge le spectateur dans les arcanes de l'espionnage moderne, où la frontière entre le bien et le mal est plus floue que jamais. Entre complots politiques et batailles d'influence, ce film nous rappelle que la vérité est un luxe dangereux dans un monde où la dissimulation est reine. Avec ses rebondissements inattendus et ses personnages ambigus, Secret Défense nous entraîne dans une course contre la montre où chaque secret révélé est une étape de plus vers la vérité, aussi amère soit-elle.